Stocks Brace for Volatility Ahead of Crucial Labor Data

Stocks markets are gearing up for a potentially volatile week as investors anxiously await crucial labor data that could provide insights into the economic recovery. The upcoming reports are expected to have a significant impact on market sentiment and investment decisions.

Labor Market Insights

Investors are closely eyeing labor market data, including employment figures, jobless claims, and wage growth. These indicators will shed light on the health of the job market and provide clues about inflationary pressures.

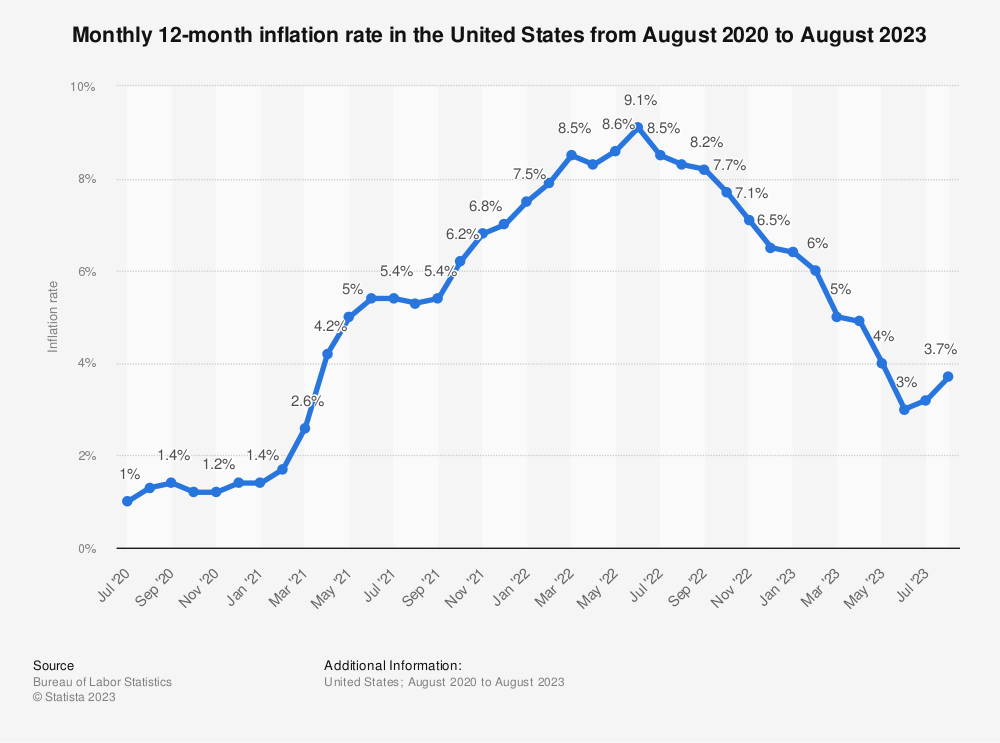

Inflation Concerns

Inflation has been a key concern for investors and policymakers alike. Labor data will help determine whether wage growth is contributing to inflation, potentially affecting the Federal Reserve’s monetary policy decisions.

Market Reaction

The stock market’s reaction to the labor data will be closely watched. Positive employment figures could boost investor confidence, while disappointing numbers may lead to increased volatility and uncertainty.

Federal Reserve’s Role

The Federal Reserve’s stance on interest rates and monetary policy is highly dependent on economic data. Strong labor market data could prompt the Fed to consider tightening monetary policy, impacting stock and bond markets.

Global Economic Factors

Global economic factors, such as supply chain disruptions and international events, also play a role in market volatility. Investors will monitor these factors alongside labor data.

Earnings Season

Earnings reports from major companies are another factor influencing stock market performance. Positive corporate earnings can mitigate concerns raised by labor data.

Investor Caution

Investors are advised to approach the coming week with caution, given the potential for market swings in response to labor data. Diversification and risk management strategies are crucial in uncertain times.

Conclusion

As stocks markets prepare for a pivotal week, the focus remains on labor data and its implications for the broader economy. The reports will shape investor sentiment and guide investment decisions, making it a crucial period for financial markets.