Nike Mixed Earnings: Revenue Fails but Earnings Impress

Nike Surprise Earnings Beat

After exceeding Wall Street forecasts for the previous 19 consecutive quarters, Nike most recent quarterly revenue fell short. However, the company exceeded earnings and gross margin projections, causing its stock price to rise significantly after-hours.

Let’s compare Nike’s fiscal first-quarter performance to Wall Street analyst forecasts:

Nike’s earnings per share of $0.94 much beyond analysts’ projections of $0.75.

The $12.94 billion in quarterly sales that Nike reported fell short of analysts’ $12.98 billion estimate.

Despite revenue shortfalls, Nike reported a quarterly net income of $1.45 billion, or 94 cents per share, up from $1.47 billion, or 93 cents per share.

The sportswear giant’s revenues rose 2% to $12.94 billion, but they fell short of experts’ $12.98 billion prediction.

After its results report, Nike’s shares rose 8% in after-hours trade.

Nike Continuous Year-Round Advice

Nike maintained its fiscal year guidance despite mixed first-quarter performance. The company expects mid-single-digit sales growth and 1.4–1.6 percentage point gross margin expansion.

Nike’s Chief Financial Officer, Matthew Friend, stressed the necessity of monitoring foreign currency exchange rates, holiday consumer demand, and the second-half wholesale order book. Given the promotional climate, we are planning on moderate markdown increases for the rest of the year, Friend said.

Nike expects moderate sales growth and a 1% gross margin rise in the second quarter.

Main Focuses and Challenges

Investors have scrutinized numerous key Nike business areas. Its Chinese market recovery, wholesale partner relationships, and student loan repayments may affect its sales.

Nike has faced bloated inventory, heavy promotions, and supply chain interruptions. Recent quarters saw lower profits due to these variables.

In the analyzed quarter, Nike’s gross margin fell 0.1 percentage points to 44.2%. Analysts expected 43.7%, but this margin exceeded them. Higher product costs and foreign exchange rates caused the reduction. Fortunately, pricing hikes compensated this decline, helping earnings exceed projections.

Sales in China increased by 5% to $1.7 billion for Nike, below the company’s goal of $1.8 billion.

Nike’s biggest market, North America, saw sales drop 2% to $5.42 billion. This outcome was slightly greater than $5.39 billion predicted.

The EMEA region outperformed estimates by 8%, with sales of $3.61 billion (instead of $3.51 billion). With a 2% increase in sales to $1.57 billion, Latin America and Asia Pacific fell short of analysts’ forecasts of $1.59 billion.

Nike’s Converse brand struggled again in the second quarter, with sales of $588 million. This was 9% lower than last year and missed analysts’ estimates.

Impact of Direct and Digital Sales

Nike’s direct channel—its stores and internet platform—grew 6% year-over-year during the quarter. This trend toward physical businesses over digital platforms suggests consumers are returning to pre-pandemic spending patterns.

Nike has prioritized DTC sales while reviving wholesale partnerships. Wholesale revenue held unchanged at $7 billion in the quarter.

Nike’s leadership stressed their willingness to engage with clients through wholesalers or direct sales. Digital and direct sales are crucial to the company’s success, thus they recommended segmenting partners across price ranges and platforms.

Future: Navigating Uncertainties

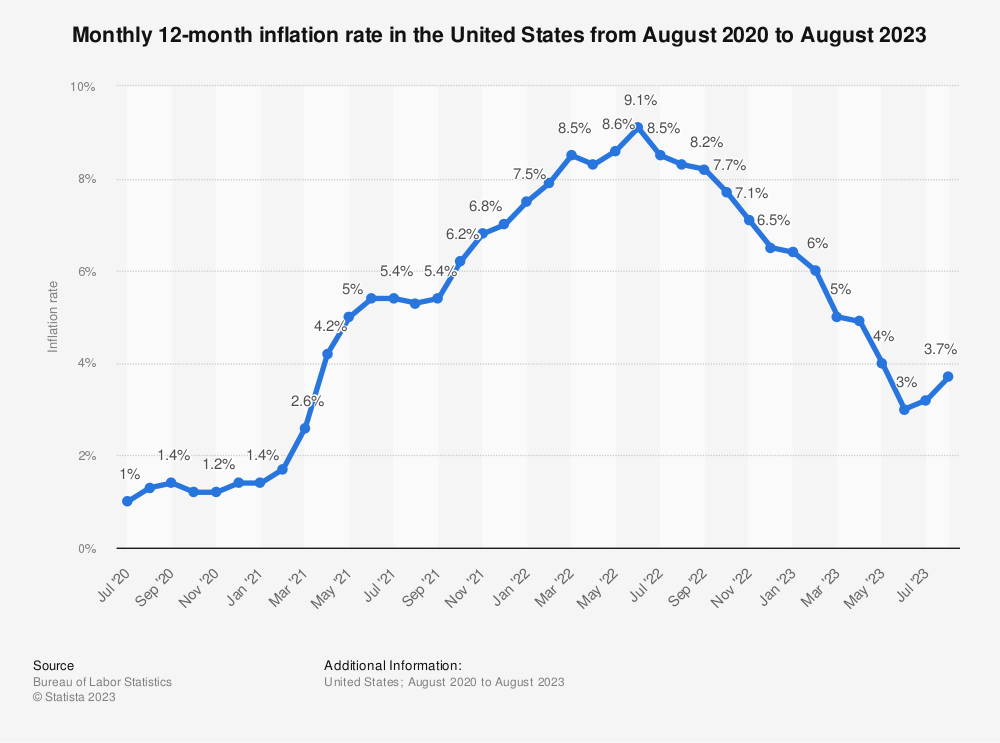

Nike remains optimistic about its adaptability and growth despite inflation and student loan obligations. The sportswear giant invests in innovation and brand to preserve its global retail dominance.

Nike’s performance in the coming quarters will reveal its resilience and ability to adapt to changing consumer patterns and retail industry issues.